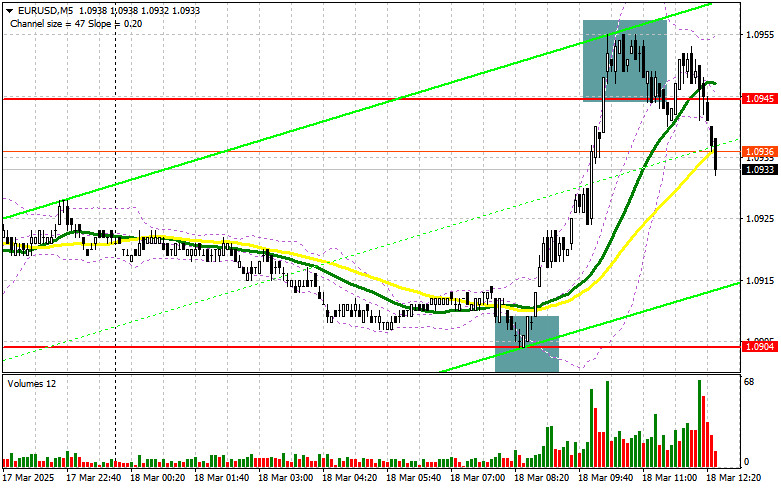

In my morning forecast, I focused on the 1.0904 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline and a false breakout around 1.0904 provided a good entry point for long positions, leading to the pair's rise towards 1.0945. The technical outlook for the second half of the day has been revised.

For Opening Long Positions on EUR/USD:

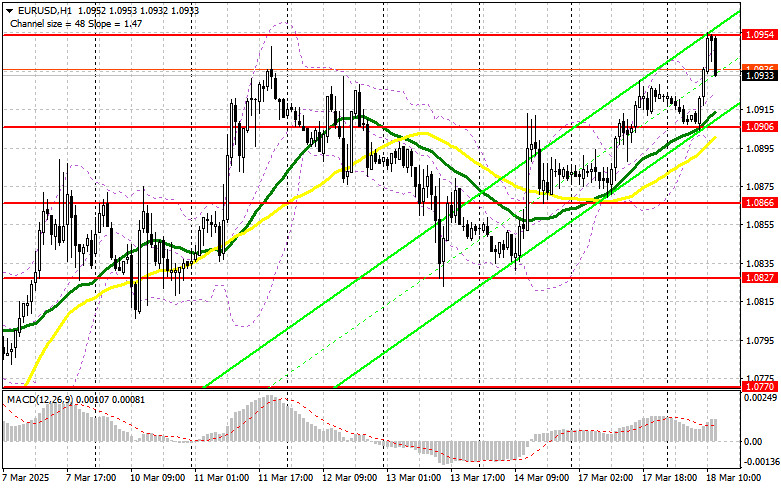

Solid ZEW index data for Germany and the Eurozone helped the euro renew its weekly high, but demand later declined. During the U.S. session, several housing market data reports will be released, starting with building permits and housing starts, followed by industrial production data, which will influence the dollar's movement. If the data comes out strong, EUR/USD may correct downward ahead of the Fed's meeting tomorrow. Given the market's low volatility, I prefer to buy on a pullback. A false breakout around 1.0906 will provide a reason to buy EUR/USD, aiming for a continuation of the bullish trend towards 1.0954. A breakout and a retest of this range from above will confirm the validity of long positions, targeting 1.0997 (a new monthly high). The ultimate target will be 1.1047, where I will take profits.

If EUR/USD declines and lacks bullish activity around 1.0906, the pair is likely to remain within a sideways range, potentially leading to a deeper correction. In this case, sellers may push the price down to 1.0866. I will only buy the euro after a false breakout at this level. If the pair falls further, I will open long positions from 1.0827, expecting a 30-35 point intraday rebound.

For Opening Short Positions on EUR/USD:

Sellers successfully defended 1.0945, shifting focus to new resistance at 1.0954, which formed during the first half of the day. A false breakout at this level, combined with strong U.S. economic data, will provide a good entry point for short positions, targeting 1.0906, just below which the moving averages currently favor bulls. A break and consolidation below this range will be another signal to sell EUR/USD, aiming for 1.0866. The final target will be 1.0827, where I will take profits.

If EUR/USD rises in the second half of the day and bears fail to defend 1.0954, buyers may push the pair even higher. In this scenario, I will delay short positions until a test of 1.0997, where I will look to sell only after a failed consolidation. If there is no downward movement there, I will open short positions from 1.1047, aiming for a 30-35 point pullback.

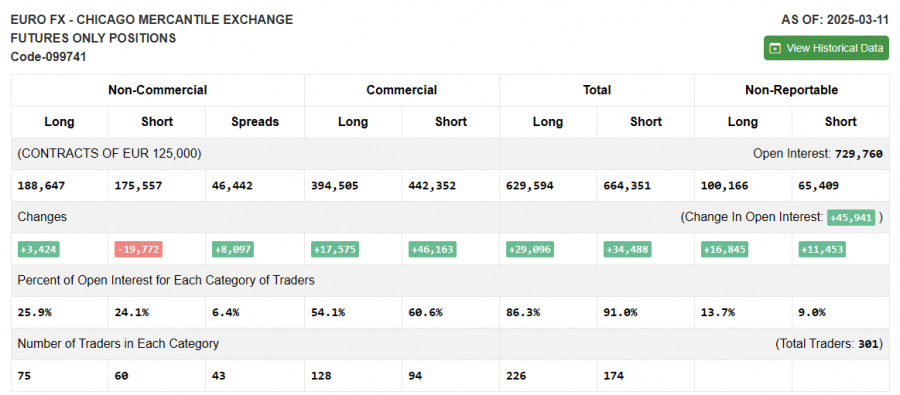

The COT report from March 11 showed an increase in long positions and a significant reduction in short positions. More traders are willing to buy euros, while sellers are quickly exiting the market. Germany's fiscal stimulus measures and the ECB's continued support for the economy have strengthened demand for EUR/USD. Additionally, progress in resolving the Ukraine conflict is also seen as a positive factor for the euro.

With the upcoming Fed meeting, a dovish stance from the central bank could cause the U.S. dollar to weaken further. The COT report showed that long non-commercial positions increased by 3,424 to 188,647, while short non-commercial positions decreased by 19,772 to 175,557. As a result, the gap between long and short positions widened by 8,097 contracts in favor of buyers.

Indicator Signals:

Moving Averages: The pair is trading above the 30 and 50-period moving averages, indicating further growth potential for the euro.

Bollinger Bands: The lower boundary of the indicator at 1.0906 serves as a key support level in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise.

- MACD (Moving Average Convergence/Divergence): Measures trend strength and potential reversals.

- Bollinger Bands: Used to identify overbought and oversold market conditions.

- Non-commercial traders: Speculators such as hedge funds and large institutions who trade futures for speculative purposes.

- Long non-commercial positions: The total long open interest of non-commercial traders.

- Short non-commercial positions: The total short open interest of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.