Trade analysis and tips for trading the euro

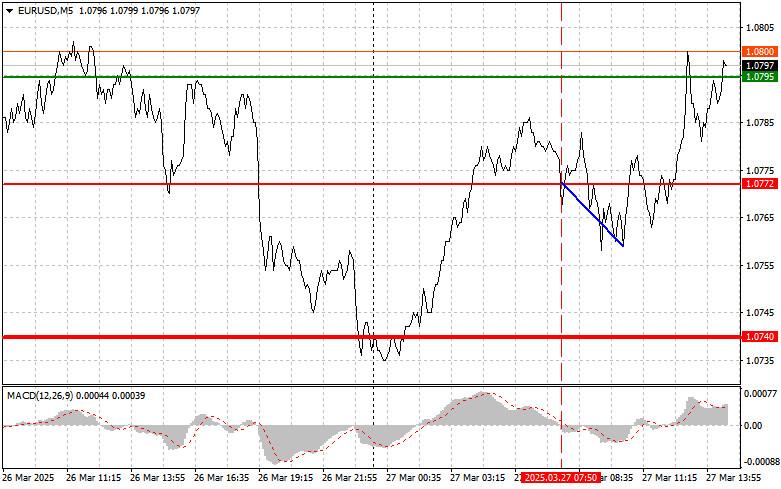

The test of the 1.0772 level occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a proper entry point for selling the euro. However, the pair failed to stage a significant drop, and after a 10-point decline, demand for the euro returned.

Published data on lending activity in the eurozone turned out to be relatively favorable, which positively impacted the euro's position. This served as a kind of relief for the currency, which had been under pressure from geopolitical uncertainty and fears of an economic downturn. However, it's worth noting that the current stabilization in the euro does not yet appear to be reliable—especially after yesterday's new auto tariffs from Donald Trump.

During the U.S. session, investor focus will shift to key macroeconomic reports. In particular, downward revisions to final U.S. GDP figures for the last quarter of the previous year could spark fresh inflows into the euro and, consequently, dollar selling. Traders will closely analyze signs of a slowdown in economic growth, which could influence future decisions by the Federal Reserve. Equally important will be the release of the Personal Consumption Expenditures (PCE) index. An increase in the PCE could strengthen expectations of tighter monetary policy, while a decline may negatively affect the dollar's position. Additionally, investors will be watching the number of initial jobless claims. An increase in this indicator may signal labor market stagnation, which could also weaken the U.S. dollar.

The day will conclude with a speech by FOMC member Thomas Barkin. His remarks on the current state of the economy and the outlook for monetary policy could trigger heightened volatility in the currency markets. Typically, this week's political statements have been interpreted in favor of dollar strength.

As for the intraday strategy, I will rely more on scenarios #1 and #2

Buy Signal

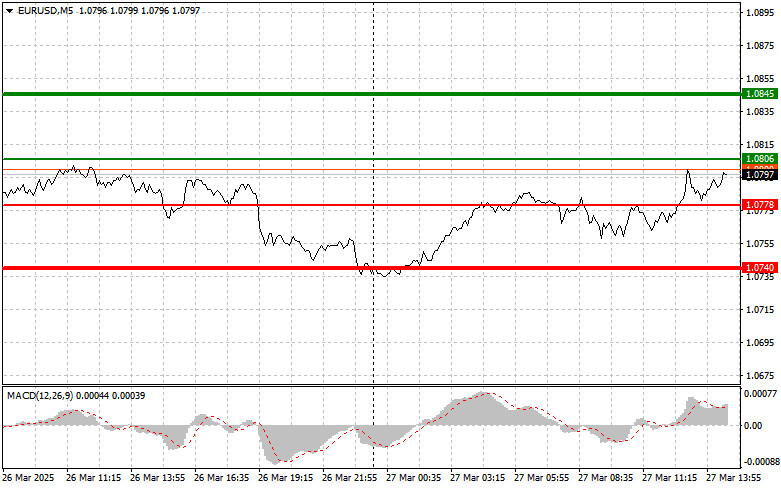

Scenario #1: Buy the euro today on a move to the 1.0806 level (green line on the chart) with a target of rising to 1.0845. At 1.0845, I plan to exit the trade and open short positions in the opposite direction, targeting a 30–35 point pullback from the entry point. A euro rally today will only be feasible following weak U.S. data and dovish Fed commentary. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0778 level, with the MACD indicator in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. A rise to the opposing levels of 1.0806 and 1.0845 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0778 level (red line on the chart). The target will be the 1.0740 level, where I plan to exit the trade and immediately buy in the opposite direction, aiming for a 20–25 point rebound. Selling pressure may return if the Fed maintains a hawkish stance. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0806 level, with the MACD indicator in overbought territory. This will limit the pair's upward potential and prompt a reversal downward. A decline to the opposing levels of 1.0778 and 1.0740 can be expected.

Chart Notes:

Thin green line – the entry price for buying the trading instrument. Thick green line – the estimated price at which to set Take Profit or manually lock in profit, as further growth beyond this level is unlikely. Thin red line – the entry price for selling the trading instrument. Thick red line – the estimated price at which to set Take Profit or manually lock in profit, as further decline beyond this level is unlikely. MACD indicator – use overbought and oversold zones as guidance when entering the market.

Important: Beginner traders in the Forex market should be extremely cautious when entering trades. It's best to stay out of the market before the release of key fundamental reports to avoid sudden price spikes. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, to trade successfully you need a clear trading plan—such as the one outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday trade