Analysis of Trades and Trading Tips for the British Pound

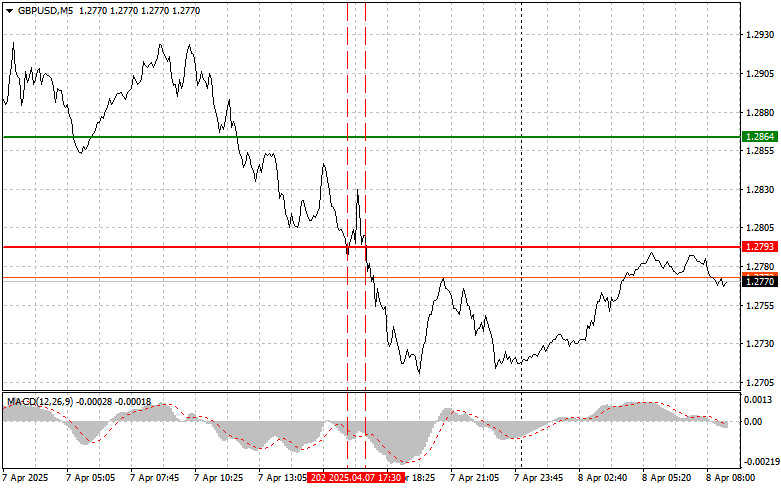

The price test of 1.2793 occurred when the MACD indicator moved significantly below the zero mark, limiting the pair's downside potential. A second test of 1.2793 while MACD was in the oversold zone triggered Buy Scenario #2. However, this trade resulted in a loss, as the expected pound growth never materialized.

Yesterday's lack of UK economic data only added to the pressure on the pair. The technical picture offers little optimism, either. The GBP/USD pair remains in a steady downtrend, breaking through one support level after another. Fundamentally, pressure on the pound stems from concerns about the UK economy following the trade tariffs and duties imposed by Donald Trump. The question of whether British policymakers can negotiate the removal of these elements remains challenging.

Today, attention will shift to the speech by Clare Lombardelli, the Bank of England's Deputy Governor for Monetary Policy. Investors and analysts will closely listen for hints on future interest rate decisions and the central bank's inflation-fighting strategy. Lombardelli is known for her balanced approach to monetary policy, and her comments often reflect the general view of the BoE's Monetary Policy Committee. However, given global economic uncertainty and trade tariffs, any deviation from expected rhetoric could spark significant market volatility. She will specifically assess the UK's inflation outlook and her views on economic growth expectations. Investors will also look for signals on how long the BoE plans to maintain current interest rate levels or when a rate cut might be considered.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1:

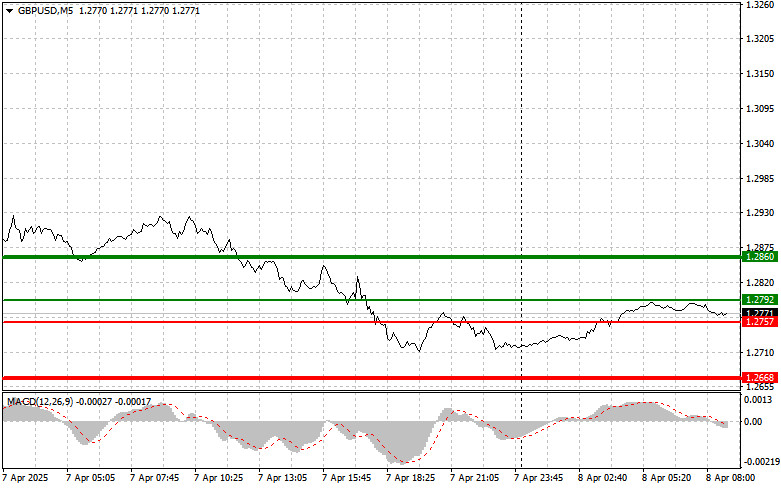

I plan to buy the pound today upon reaching the entry point at 1.2792 (green line on the chart), with a target of 1.2860 (thicker green line on the chart). Around 1.2860, I plan to exit the long position and open a short one in the opposite direction, aiming for a 30–35 pip pullback. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2:

I also plan to buy the pound today if there are two consecutive tests of the 1.2757 level while MACD is in the oversold zone. This would limit the pair's downward potential and lead to a reversal to the upside. A rise toward 1.2792 and 1.2860 may follow.

Sell Signal

Scenario #1:

I plan to sell the pound today after a breakout below 1.2757 (red line on the chart), which may lead to a sharp drop in the pair. The key target for sellers will be 1.2668, where I plan to exit short positions and open long ones in the opposite direction (expecting a 20–25 pip bounce). Selling the pound fits the context of the new trend.

Important! Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2:

I also plan to sell the pound today if there are two consecutive tests of the 1.2792 level while MACD is in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. A drop toward 1.2757 and 1.2668 may follow.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.