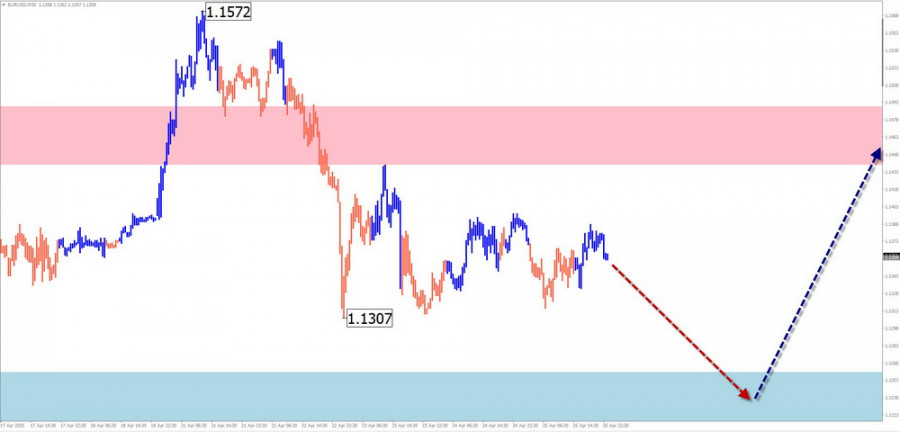

EUR/USD

Analysis:

Since February of this year, the euro has been strengthening against the U.S. dollar. The intermediate resistance zone on the daily timeframe, breached three weeks ago, has turned into support. The pair is currently forming a correction along this support before resuming its upward movement, and the correction remains incomplete.

Forecast:

The sideways movement is likely to continue at the start of the upcoming week. A downward move is more probable early on, with higher volatility and a bullish reversal expected closer to the weekend.

Potential Reversal Zones:

- Resistance: 1.1440/1.1490

- Support: 1.1260/1.1210

Recommendations:

- Sales: Have limited potential and could lead to losses.

- Purchases: Can become the main trading strategy after confirmed reversal signals near support.

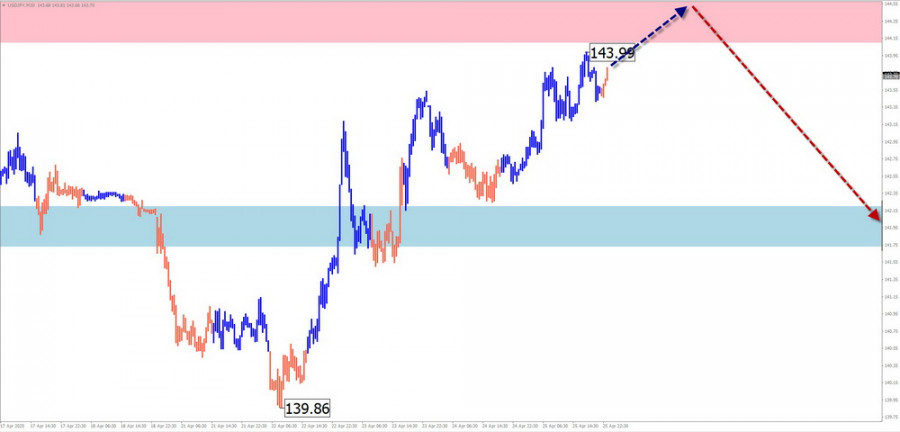

USD/JPY

Analysis:

The bearish wave that started late last year continues to develop on the major yen pair's chart. The current leg of the primary trend dates back to April 9. After contacting a strong support zone, the pair retraced upward throughout last week. The calculated resistance lies at the upper boundary of the potential reversal zone.

Forecast:

The overall bullish bias may end during the upcoming week. Some pressure on the resistance zone early in the week is possible, followed by a reversal and renewed decline toward the support area. Higher volatility is likely toward the end of the week.

Potential Reversal Zones:

- Resistance: 144.10/144.60

- Support: 142.20/141.90

Recommendations:

- Sales: Can be considered after confirmed reversal signals appear.

- Purchases: Not recommended this week.

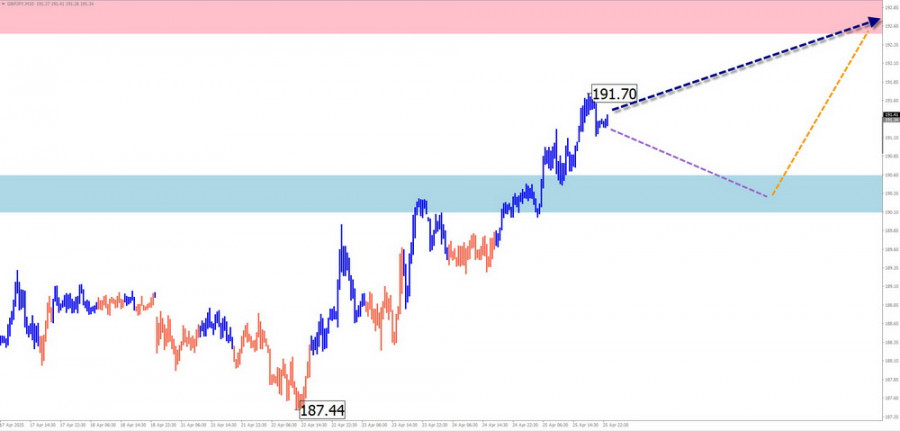

GBP/JPY

Analysis:

Since February, the GBP/JPY cross has been forming a broad descending flat pattern. The concluding wave (C) segment, starting from April 9, is developing an intermediate correction that is not yet complete.

Forecast:

Expect sideways price action for the next couple of days, possibly with a brief decline that should not go below the support zones. A resumption of upward movement is most likely in the second half of the week, with volatility peaking around economic data releases.

Potential Reversal Zones:

- Resistance: 192.50/193.00

- Support: 190.60/190.10

Recommendations:

- Sales: High-risk, may result in losses.

- Purchases: Could become the primary trading direction after confirmed reversal signals.

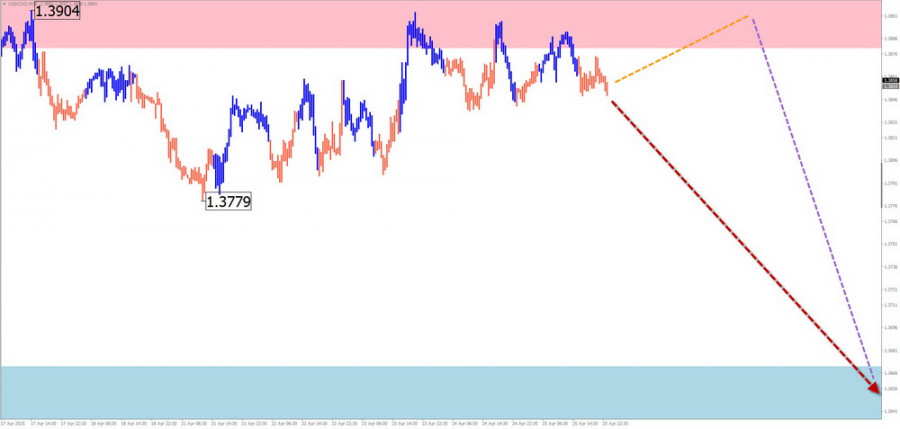

USD/CAD

Analysis:

In recent months, the USD/CAD has been driven by a downward wave. After breaking another support level, the pair has been forming an intermediate correction along it. Price extremes have created a "horizontal pennant" pattern, with prices trapped between opposing zones.

Forecast:

Expect sideways movement in the early part of the week. Later in the week, the probability of a bearish reversal increases. The calculated support lies at the upper boundary of a major potential reversal zone.

Potential Reversal Zones:

- Resistance: 1.3880/1.3930

- Support: 1.3670/1.3620

Recommendations:

- Purchases: Not advisable, high risk.

- Sales: Only recommended after confirmed reversal signals near resistance.

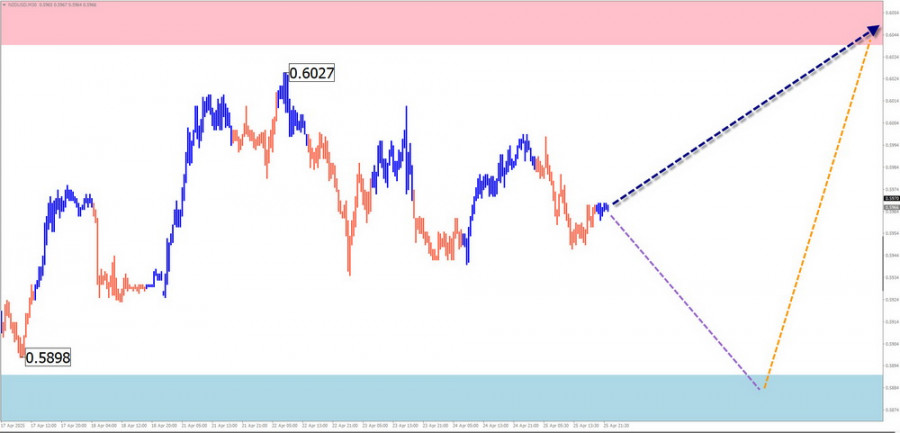

NZD/USD

Analysis:

Short-term price movement for NZD/USD has been shaped by an ascending wave over the past three weeks. After contacting the lower boundary of a potential reversal zone, a correction began. The structure remains incomplete at the time of analysis.

Forecast:

Expect sideways movement early in the week, with a downward bias. Prices could decline toward the support zone before rebounding later in the week amid increasing volatility.

Potential Reversal Zones:

- Resistance: 0.6040/0.6090

- Support: 0.5890/0.5840

Recommendations:

- Sales: Possible in small volumes during individual sessions; potential is limited by support.

- Purchases: Could be used after confirmed reversal signals near the support zone.

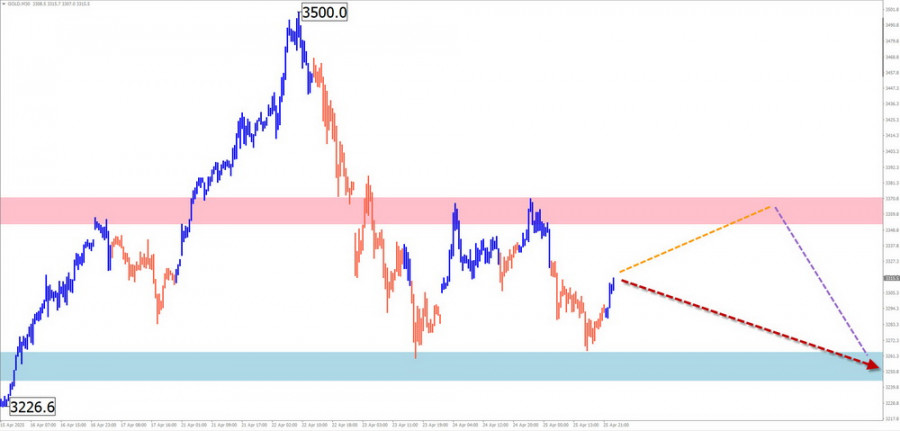

GOLD

Gold remains near its peak levels. The latest bullish phase began at the start of April. After setting new record highs, gold prices have started to correct downward.

Forecast:

Expect an overall sideways trend next week. Early in the week, an upward movement is more likely, but limited to the resistance zone. A renewed downward trend is more likely toward the end of the week.

Potential Reversal Zones:

- Resistance: 3350.0/3370.0

- Support: 3240.0/3220.0

Recommendations:

- Purchases: Carry a high degree of risk and could result in losses.

- Sales: Can be considered after confirmed reversal signals using small volume sizes.

Explanations: In Simplified Wave Analysis (SWA), all waves consist of three parts (A-B-C). Each timeframe analyzes the last unfinished wave. Dashed lines indicate expected movements.

Warning: The wave algorithm does not account for the duration of movements over time!