S&P 500, Dow rally after volatile session

The S&P 500 and Dow ended Monday in the green despite high market volatility. Investors watched with interest for hints of possible progress in tariff talks ahead of a busy week of corporate earnings and key economic data.

Tech drags Nasdaq lower

While the broader market showed moderate optimism, the tech sector (.SPLRCT) showed weakness, dragging the Nasdaq lower. At the same time, the dollar strengthened against major currencies, and gold, traditionally considered a safe haven asset in times of instability, rose again.

Washington hints at improvement in tariff talks

Treasury Secretary Scott Bessent said Monday that key trading partners have offered "very favorable" tariff terms. He also noted that China's recent moves to lift some retaliatory tariffs on US goods demonstrate a desire to ease tensions between the world's two largest economies.

Experts warn of uncertainty ahead

According to analyst Mayfield, without real breakthroughs in the talks or strong positive data on the economy and corporate earnings, markets risk being stuck in the current range for an indefinite period.

"Unless there is meaningful progress on the trade front this week or a tangible uptick in earnings, we will remain sideways," he said.

Recession risks remain

Despite cautious optimism over trade talks, economists warn that the likelihood of a global recession remains high. From solid global growth expected just three months ago, the outlook has now noticeably worsened amid protectionist US policies.

Microsoft, Apple and Amazon set to release quarterly results

It's going to be a busy week, with investors' attention focused on the first-quarter financial reports from tech giants Microsoft (MSFT.O), Apple (AAPL.O) and Amazon.com (AMZN.O). Their results could set the tone for the stock market in the coming days.

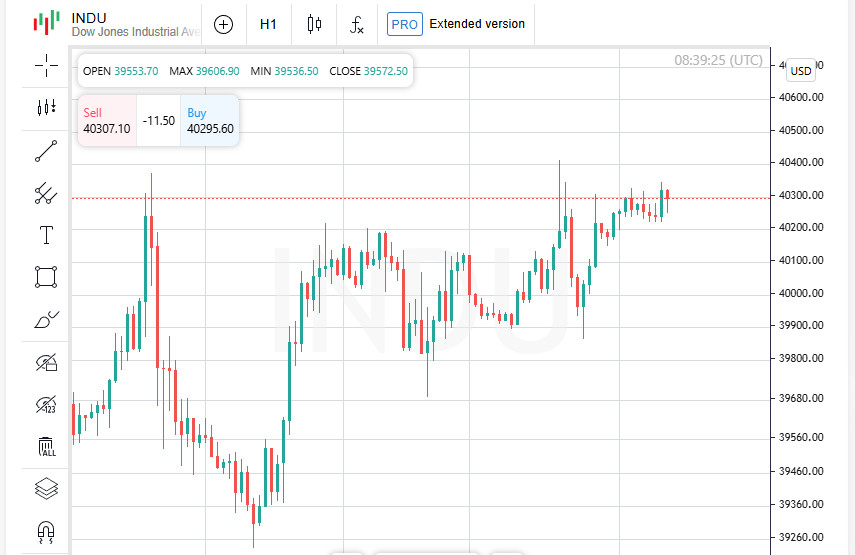

Dow and S&P 500 gain, Nasdaq fails to hold on

The Dow Jones Industrial Average (.DJI) ended the session up 114.09 points, up 0.28% to 40,227.59. The S&P 500 (.SPX) also closed higher, up 3.54 points, or 0.06%, to 5,528.75. Meanwhile, the Nasdaq Composite (.IXIC) came under pressure, losing 16.81 points, or 0.10%, to 17,366.13.

Europe Rises on Optimism

Optimism about a possible easing of trade tensions between the US and China also inspired European stock markets. The pan-European STOXX 600 index (.STOXX) rose 0.53%, while the broader FTSEurofirst 300 index (.FTEU3) added 10.13 points, representing a rise of 0.49%.

Global Markets Advance

The MSCI World Index (.MIWD00000PUS), which tracks stocks around the world, rose 3.35 points, or 0.41%, to 828.09. Emerging markets also showed solid gains, with the MSCI Emerging Markets Index (.MSCIEF) up 6.35 points, or 0.58%, to end the day at 1,103.45.

Asia follows global trends

Asia-Pacific markets were not left out. The region's broadest MSCI index excluding Japan (.MIAPJ0000PUS) added 0.62% to 574.20. Japan's Nikkei (.N225) also showed positive dynamics, rising 134.25 points, or 0.38%, to 35,839.99.

The US currency weakened amid optimism

The dollar fell at the start of a busy week, as market participants looked with hope at possible progress in US-China trade talks and prepared for a series of key economic events. The dollar index, which tracks the currency against six major global currencies, lost 0.8% to 98.93.

Euro and pound gain strength

The European currency confidently added 0.51%, reaching $1.1422 per euro. The British pound also showed solid growth, strengthening by 0.9% and trading at $1.3434, supported by domestic political optimism.

Yen strengthens, peso loses ground

The dollar weakened by 1.13% against the Japanese yen, falling to 142.05. At the same time, the Mexican peso lost 0.21% of its value, fixing the rate of 19.57 to the US dollar. The strengthening of the yen shows that investors are still looking for safe haven assets amid global uncertainty.

Canadian dollar rises amid election activity

The Canadian currency strengthened by 0.26%, trading at C$1.38 per dollar. Canada is set to hold elections on Monday, with the Trump administration's tariff policy and speculation about the country's possible annexation among the hottest topics.

Oil Loses Ground

Oil prices fell as traders weighed the possibility of increased supply from OPEC+ amid ongoing trade risks. U.S. WTI crude fell 1.54% to $62.05 a barrel, while North Sea Brent ended the day at $65.86, down 1.51%.

Gold Back in the Spotlight

Amid a weaker dollar and uncertainty in the markets, demand for safe havens grew. Spot gold added 0.98% to $3,350.59 an ounce. U.S. gold futures rose less significantly, by 0.06%, to $3,284.50 an ounce.

Dollar under pressure: markets ponder Trump's first 100 days

While US stock futures are cautiously recovering their positions, returning to the levels of early April, the dollar continues to retreat. In the first 100 days of Donald Trump's presidency, it has come close to its deepest monthly decline in many years.

Traders are actively dumping the dollar, fearing that tariff policy will hit economic growth, productivity and investment attractiveness of the USA. At the same time, the dollar's reputation as a "safe haven" is weakening, and Trump's unstable public statements are only increasing nervousness in global markets.

Promises to cancel tariffs have not convinced investors yet

The latest news about a partial refusal to introduce new tariffs on cars was met with restraint by the markets. European and US futures reacted with modest growth during the Asian session. Investors are waiting for clearer signals about a real easing of tariff pressure between the United States and China, two economic giants embroiled in a bitter trade war.

Businesses are given hope: White House meeting

Still, the concession to automakers may indicate that Trump is beginning to listen more closely to the voice of business. A large meeting is planned for Wednesday at the White House: Trump will host more than two dozen top managers, including the heads of Nvidia, Toyota, SoftBank and Hyundai. This meeting could be an important indicator of the direction in which U.S. trade policy will develop in the near future.

The eurozone is preparing to publish important macroeconomic data

The release of consumer confidence statistics in the eurozone is scheduled for Tuesday, as well as the publication of inflation data in Spain and Belgium. These indicators could significantly affect expectations regarding the policy of the European Central Bank. On the corporate front, investors will be focused on the earnings reports of major players such as HSBC (HSBA.L), Adidas (ADSGn.DE) and Logitech (LOGN.S), which are directly dependent on the tariff policy.

US earnings season is gaining momentum

General Motors and Visa at the start of the week ahead of tech giants

In the US, the day promises to be eventful: General Motors (GM.N) and Visa (V.N) will present their results. However, special attention will be focused on the end of the week, when the titans of the tech sector - Apple (AAPL.O), Amazon (AMZN.O) and Microsoft (MSFT.O) - will present their quarterly reports. Their results are likely to set the general tone for the market in the short term.