Analysis of Trades and Trading Tips for the British Pound

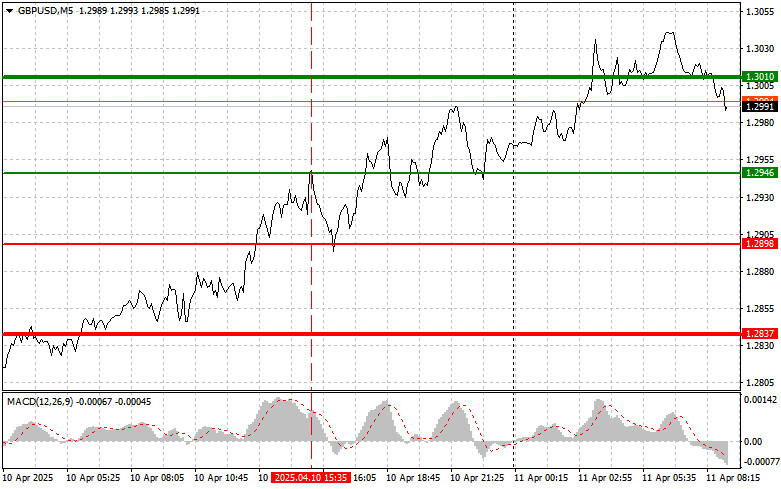

The price test at 1.2946 occurred when the MACD indicator moved significantly above the zero line. However, the test coincided with the release of U.S. data that justified a GBP buy based on expectations of U.S. dollar weakness. Despite this, the pair failed to show a rapid upward move, resulting in a loss being locked in.

Contrary to analysts' expectations, the U.S. Consumer Price Index declined in March, putting significant pressure on the U.S. dollar. This development opens the door for the Federal Reserve to ease monetary policy by cutting interest rates, which could stimulate an economy under pressure from the trade war initiated by Donald Trump. The unexpected slowdown in inflation may prompt a review of current monetary strategies. While the Fed had previously indicated a commitment to maintaining high interest rates to curb inflation, the new economic data casts doubt on the rationale for such a policy.

Strong GDP and industrial production data from the UK could trigger another wave of strengthening for GBP/USD. Conversely, if the figures disappoint, the pair could undergo a noticeable downward correction. Traders will also be closely watching the UK trade balance. Investors are keenly awaiting economic releases from the UK as they provide important insights into the country's economic health. In particular, GDP data is a key indicator of economic well-being, reflecting the total value of goods and services produced over a specific period. A significant increase in GDP signals stable economic growth and can lead to pound appreciation.

Similarly, a positive trend in industrial production indicates a healthy manufacturing sector, contributing to broader economic expansion. Growth in industrial output could boost exports and investment, further strengthening the pound.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

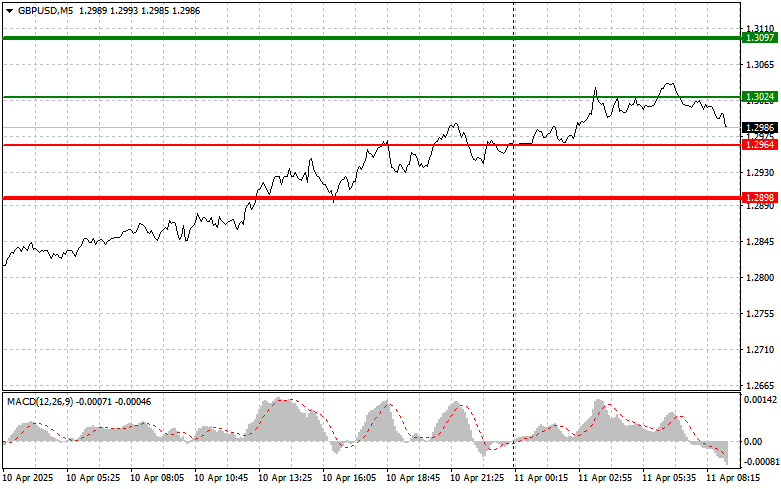

Scenario #1: I plan to buy the pound today at the 1.3024 entry point (green line on the chart), targeting a rise to 1.3097 (thicker green line on the chart). Around 1.3097, I plan to exit long positions and open a short position in the opposite direction (aiming for a 30–35 pip pullback from the level). Pound growth today is only likely after strong GDP data.

Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.2964 while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward reversal—expected targets: 1.3024 and 1.3097.

Sell Signal

Scenario #1: I plan to sell the pound today after the pair breaks below 1.2964 (red line on the chart), triggering a sharp decline. The key target for sellers will be 1.2898, where I plan to exit short positions and open a buy trade in the opposite direction (targeting a 20–25 pip rebound). Selling the pound should be done with caution.

Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3024 while the MACD is in the overbought zone. This will limit the pair's upside potential and lead to a downward reversal—expected targets: 1.2964 and 1.2898.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.